All Categories

Featured

There is no one-size-fits-all when it comes to life insurance policy./ wp-end-tag > In your hectic life, economic independence can seem like an impossible objective.

Fewer companies are using typical pension strategies and many companies have lowered or ceased their retired life strategies and your ability to depend solely on social protection is in question. Even if advantages have not been minimized by the time you retire, social security alone was never intended to be sufficient to pay for the lifestyle you desire and should have.

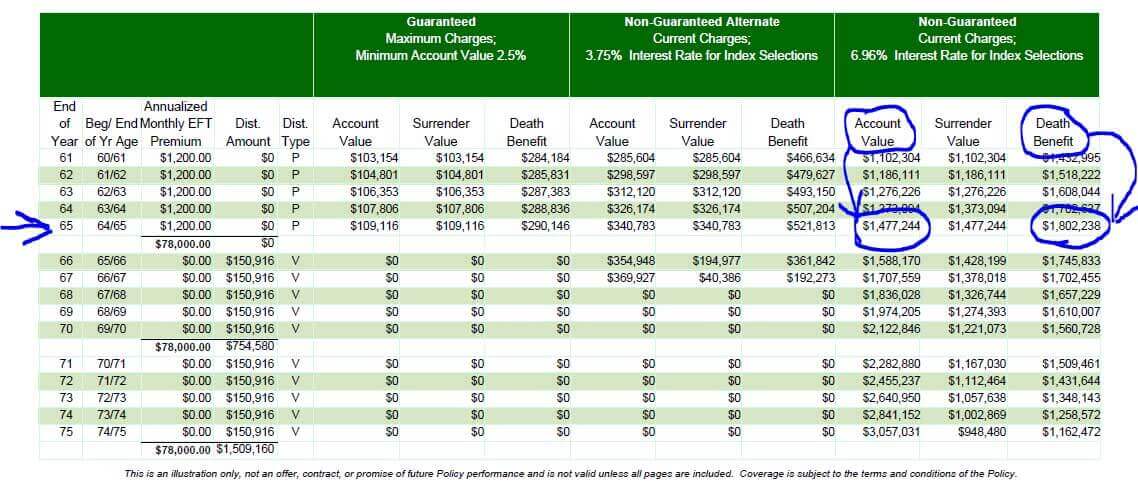

/ wp-end-tag > As part of a sound financial approach, an indexed universal life insurance policy can assist

you take on whatever the future brings. Before devoting to indexed universal life insurance policy, below are some pros and cons to take into consideration. If you select a good indexed universal life insurance coverage strategy, you may see your money value expand in worth.

Universal Life Vs Whole Life Which Is Better

Since indexed global life insurance policy needs a certain level of danger, insurance policy firms have a tendency to maintain 6. This kind of plan also provides.

Normally, the insurance coverage company has a vested rate of interest in carrying out far better than the index11. These are all factors to be considered when selecting the best kind of life insurance for you.

Eiul Life Insurance

Nonetheless, given that this type of policy is much more complex and has an investment component, it can commonly feature higher premiums than various other policies like whole life or term life insurance. If you don't believe indexed universal life insurance policy is ideal for you, below are some options to take into consideration: Term life insurance policy is a momentary policy that usually uses protection for 10 to three decades.

Indexed universal life insurance coverage is a sort of plan that offers more control and adaptability, in addition to higher money value growth capacity. While we do not use indexed global life insurance policy, we can offer you with even more details regarding entire and term life insurance policy policies. We recommend exploring all your choices and chatting with an Aflac agent to find the ideal suitable for you and your family members.

The remainder is contributed to the cash worth of the policy after fees are subtracted. The money value is attributed on a month-to-month or yearly basis with rate of interest based on increases in an equity index. While IUL insurance might confirm important to some, it is very important to comprehend exactly how it functions before buying a policy.

Latest Posts

Guarantee Universal Life

Transamerica Index Universal Life Insurance

Principal Group Universal Life